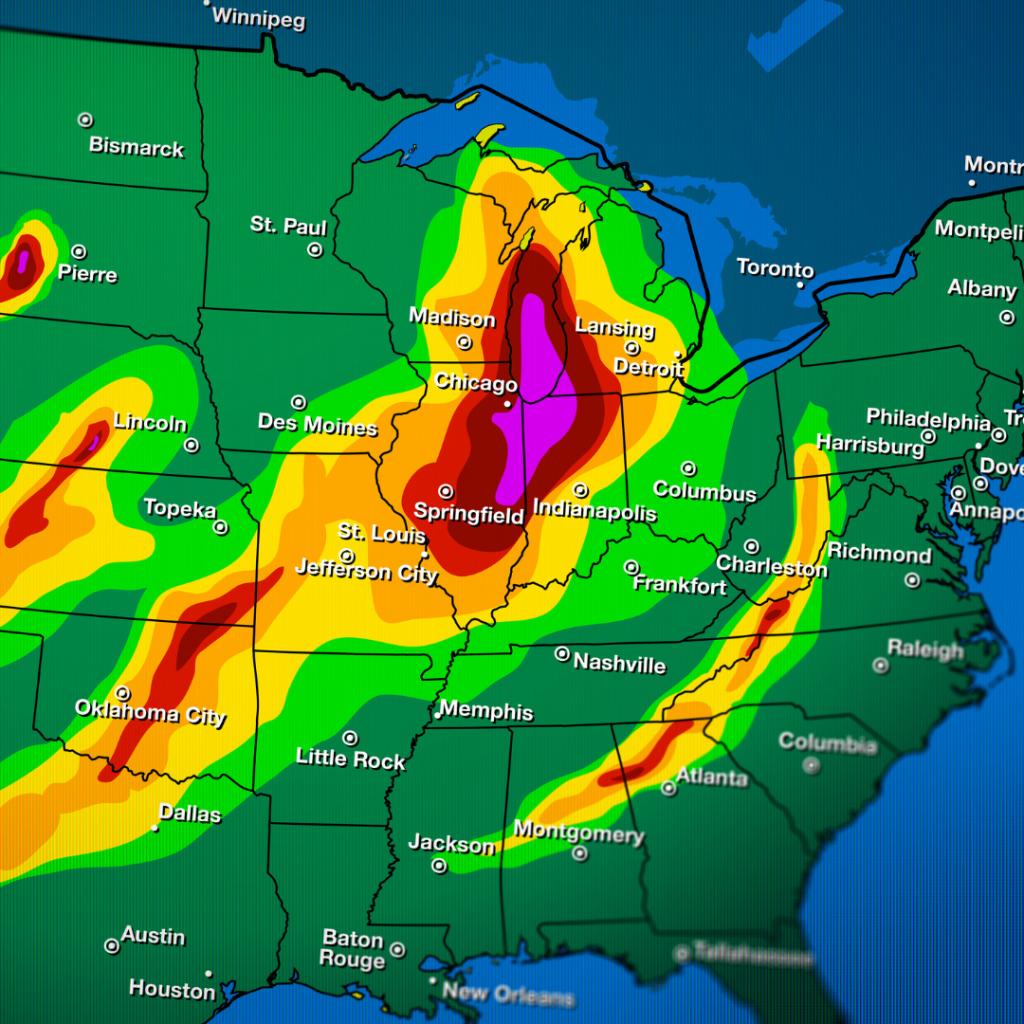

As winter approaches, it is crucial for small businesses to prepare for the challenges the season’s weather brings. Whether it’s potential property damage or changes in customer behavior, winter can significantly impact a company’s operations. This article provides 10 tips for effectively winterizing a small business. [Read more…]